How Will New Accounting Changes Affect Fulls Service Leasing

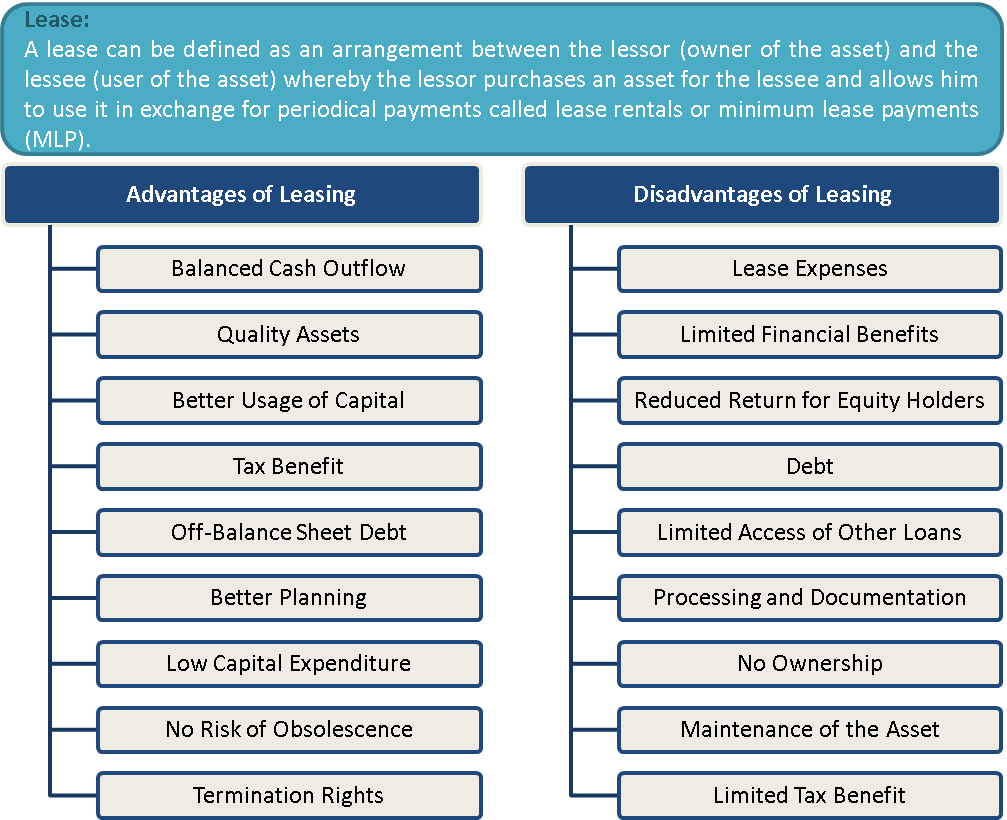

Leasing is becoming a preferred solution to resolve fixed asset requirements vs. purchasing the asset. While evaluating this investment, information technology is essential for the possessor of the capital to understand whether leasing would yield ameliorate returns on capital or not. Permit us have a expect at the advantages and disadvantages of leasing:

What is a Lease or Leasing?

A famous quote past Donald B. Grant says, "Why ain a cow when the milk is so cheap? All yous really need is milk and not the cow." The concept of Charter is influenced by this quote. We tin compare 'milk' with the 'rights to utilize an nugget' and 'moo-cow' with the 'asset' itself. Ultimately, a person who wants to manufacture a production using machinery tin can become to use that mechanism nether a leasing organization without owning information technology.

Tabular array of Contents

- What is a Lease or Leasing?

- Purpose of Leasing

- Benefits of Taxes

- Avoid Ownership and thereby Avoiding Risks of Ownership

- Advantages of Leasing

- Balanced Greenbacks Outflow

- Quality Avails

- Better Usage of Capital

- Tax Benefit

- Off-Rest Canvas Debt

- Better Planning

- Low Capital Expenditure

- No Risk of Obsolescence

- Termination Rights

- Disadvantages of Leasing

- Lease Expenses

- Express Financial Benefits

- Reduced Return for Equity Holders

- Debt

- Limited Admission to Other Loans

- Processing and Documentation

- No Ownership

- Maintenance of the Asset

- Limited Tax Do good

- Conclusion

A charter tin be divers as an system between the lessor (owner of the nugget) and the lessee (user of the asset). Whereby the lessor purchases an asset for the lessee and allows him to utilize it in exchange for periodical payments. These payments are called lease rentals or minimum lease payments (MLP). Leasing is benign to both parties for availing tax benefits or doing tax planning.

At the conclusion of the lease menstruum, the asset goes back to the lessor (the possessor) in an absence of whatsoever other provision in the contract regarding compulsory buying of the asset by the lessee (the user). There are four different things possible post-termination of the charter understanding.

- The lease is renewed by the lessee perpetually or for a definite period of fourth dimension.

- The nugget goes dorsum to the lessor.

- The nugget comes back to the lessor and he sells information technology off to a third political party.

- Lessor sells to the lessee.

Purpose of Leasing

The purpose of choosing a lease tin can exist many. Generally, a lease is structured for the following reasons.

Benefits of Taxes

The revenue enhancement benefit is availed to both the parties, i.east. Lessor and Lessee. Lessor, being the owner of the asset, can merits depreciation as an expense in his books. And therefore get the tax benefit. On the other paw, the lessee tin claim the MLPs i.due east. lease rentals equally an expense and achieve tax benefit in a similar way.

Avoid Ownership and thereby Avoiding Risks of Ownership

Ownership is avoided to avert the investment of coin into the asset. It indirectly keeps the leverage low and hence opportunities of borrowing coin remain open for the business concern. A Lease is an off-remainder sheet item.

Advantages of Leasing

Balanced Greenbacks Outflow

The biggest advantage of leasing is that greenbacks outflow or payments related to leasing are spread out over several years, hence saving the burden of one-time significant cash payments. This helps a business to maintain a steady greenbacks-flow profile.

Quality Assets

While leasing an asset, the ownership of the asset still lies with the lessor whereas the lessee just pays the rental expense. Given this agreement, it becomes plausible for a business organisation to invest in good quality assets which might await unaffordable or expensive otherwise.

Ameliorate Usage of Capital

Given that a company chooses to lease over investing in an asset by purchasing, it releases capital for the business to fund its other upper-case letter needs or to salve money for a amend majuscule investment decision.

Tax Benefit

Leasing expenses or lease payments are considered as operating expenses, and hence, of interest, are tax-deductible.

Off-Balance Canvass Debt

Although charter expenses get the aforementioned treatment equally involvement expenses, the charter itself is treated differently from debt. Leasing is classified as an off-residue sheet debt and doesn't announced on the company's residual sheet.

Meliorate Planning

Lease expenses commonly remain abiding over the asset's life or lease tenor or grow in line with inflation. This helps in planning expenses or greenbacks outflow when undertaking a budgeting practice.

Low Capital letter Expenditure

Leasing is an ideal choice for a newly set-upward business concern given that it means lower initial toll and lower CapEx requirements.

No Risk of Obsolescence

For businesses operating in the sector, where at that place is a loftier chance of technology becoming obsolete, leasing yields great returns and saves the business from the risk of investing in a engineering science that might soon get outdated. For example, it is ideal for the technology business.

Termination Rights

At the end of the leasing period, the lessee holds the right to buy the holding and has a termination option for the leasing contract, thus providing flexibility to the business.

Disadvantages of Leasing

Lease Expenses

Lease payments are treated as expenses rather than as disinterestedness payments towards an asset.

Limited Fiscal Benefits

If paying lease payments towards state, the business cannot benefit from any appreciation in the value of the state. The long-term charter understanding besides remains a brunt on the business every bit the understanding is locked and the expenses for several years are fixed. In a case when the use of an nugget does not serve the requirement after some years, lease payments get a burden.

Reduced Return for Equity Holders

Given that lease expenses reduce the cyberspace income without any appreciation in value, it means express returns or reduced returns for an equity shareholder. In such a case, the objective of wealth maximization for shareholders is non accomplished.

Debt

Although a lease doesn't appear on the balance sheet of a company, investors nonetheless consider long-term leases as debt and arrange their valuation of a business to include leases.

Express Access to Other Loans

Given that investors treat long-term leases every bit debt, it might become difficult for a business to tap majuscule markets and enhance further loans or other forms of debt from the market.

Processing and Documentation

Overall, entering into a charter understanding is a complex process and requires thorough documentation and proper examination of an asset existence leased.

No Ownership

At the finish of the leasing period, the lessee doesn't end up becoming the owner of the nugget though quite a good sum of payment is being done over the years towards the nugget.

Maintenance of the Asset

The lessee remains responsible for the maintenance and proper operation of the asset existence leased.

Limited Tax Benefit

For a new starting time-up, the tax expense is likely to be minimal. In these circumstances, there is no added tax reward that can exist derived from leasing expenses.

Conclusion

To summarize, lease finance is advisable for an individual or concern which cannot raise coin through other means of finance like debt or term loan because of the lack of funds. The business or lessee cannot even arrange the downwardly payment money to heighten debt. The charter works best for him. On the other hand, the lessor, who wants to invest his money efficiently, becomes the financier for the lessee and earns the interest.

To take an informed conclusion regarding the apply of diverse types of charter finance, we may accept a look at the comparing of lease finance with other forms of finance.

Charter Finance vs Term Loan

Lease Finance vs Installment Sale

Help us make this article better

- UNIFICATION OF LEASING IN INTERNATIONAL BENCHMARK [Source]

Source: https://efinancemanagement.com/sources-of-finance/advantages-and-disadvantages-of-leasing

Posted by: lukasikracrought.blogspot.com

0 Response to "How Will New Accounting Changes Affect Fulls Service Leasing"

Post a Comment